In today’s fast-moving markets, ownership patterns reveal powerful stories about investor confidence, corporate control, and emerging risks.

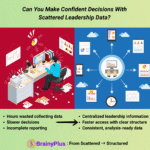

The challenge?

Ownership data is often scattered across multiple filings, delayed, and inconsistent. By the time decision-makers piece it together, critical signals may be missed-from activist stake-building to institutional exits or ESG-driven portfolio shifts.

Why Structured Data Matters

Ownership information from public filings is valuable but often fragmented, delayed, and inconsistent. Structured data solves this by:

Consolidating disclosures from multiple sources into one format

Cleaning and standardizing information for accurate analysis

Making ownership trends visible as soon as filings become public

For decision-makers, structured data turns complex raw information into actionable intelligence.

It shifts decision-making from reactive monitoring to proactive strategy.

5 Ways Structured Ownership Data Creates Value

Detect Early Signals

Identify activist stake-building, insider selling, or institutional buying patterns as soon as they surface in public filings — structured and ready for analysis.

Measure Market Confidence

Track institutional inflows and ownership changes to understand how major investors view a company or sector.

Strengthen Governance Oversight

Spot concentrated voting power, related-party holdings, or potential governance risks that raw disclosures often obscure.

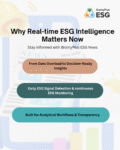

Track ESG Momentum

Monitor how sustainability-focused funds adjust their positions after ESG announcements — crucial for long-term planning.

Support M&A and Strategic Decisions

Map shareholder dynamics to uncover friendly stakeholders, potential deal blockers, or early signs of acquisition interest.

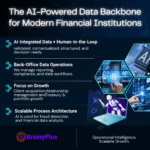

The BrainyPlus Advantage

At BrainyPlus, we transform publicly available ownership data into decision-ready intelligence through:

Analyst-verified accuracy-every dataset reviewed by experts

Customized delivery-dashboards, APIs, or data files, built for your workflow

Reliable coverage-institutional flows, ESG updates, M&A signals, all in one place

So decision-makers can act with speed, clarity, and confidence.

#StockOwnership #InvestmentIntelligence #CapitalMarkets #DataOperations