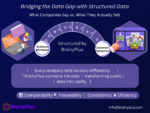

In private markets, the biggest challenge isn’t lack of opportunity-it’s lack of visibility.

While public companies disclose detailed financial reports, private companies do not. Their fundraising activity-often the clearest signal of growth, investor confidence, and market direction-is fragmented across press releases, industry publications, company releases, and social media.

At BrainyPlus, we specialize in researching, collecting, structuring,& validating publicly available fundraising news data-delivered only on order and aligned with the needs of private equity professionals.

What kind of fundraising news data do we collect?

Funding Rounds–Seed, Series A–E, growth rounds, and late-stage financing.

Investor Details–Names, profiles, preferences, and past investments of participating investors.

Valuation Signals–Reported or estimated post-money valuations and benchmarks.

Market Activity–Announcements from company websites, industry publications, and trusted media.

Timing & Trends–Frequency, size, and momentum of fundraising across sectors and geographies.

Why is this important?

Structured fundraising news data helps private equity firms:

Source&Screen Deals–Spot potential targets early and strengthen pipelines.

Support Due Diligence–Verify fundraising history, investor participation, and market credibility.

Monitor Portfolios–Track real-time activity of portfolio companies and competitors.

Optimize Exits–Use fundraising benchmarks to plan valuations and timing.

Guide Strategy–Spot industry trends and align investment approaches.

Use Cases for Private Equity Firms

•Deal Sourcing & Screening: Build a wide funnel of opportunities and prioritize high-potential targets.

•Due Diligence: Validate claims with historical funding data and investor sentiment.

•Portfolio Monitoring: Benchmark portfolio companies and detect early warning signs.

•Exit Optimization: Identify optimal exit timing and realistic valuations.

•Market Intelligence: Track sector-level fundraising trends to guide long-term strategies.

Our Expertise

BrainyPlus go beyond collection.

Comprehensive Research–Scanning multiple public sources for relevant and credible information.

Structured Data–Organized in formats aligned with client objectives.

Quality Assurance–Multi-level validation for accuracy and completeness.

On-Demand Delivery–Information researched and prepared based on client requests.

When private equity firms access structured fundraising news data, they bridge the information gap in private markets. This enables smarter sourcing, sharper diligence, stronger monitoring, and more confident exits.

We turns public fundraising news into actionable investment intelligence-empowering your team to move faster and decide smarter.

#PrivateEquity #FundraisingNews #DealSourcing #DueDiligence #PortfolioMonitoring #MarketIntelligence