Every investor, analyst, and board member knows-executive pay tells a story about what a company values, how it measures success, and whether leadership incentives align with long-term growth.

Yet for decision-makers, this is one of the toughest datasets to work with.

It’s public, yes-but fragmented, inconsistent, and often misleading.

Here’s what decision-makers often miss.

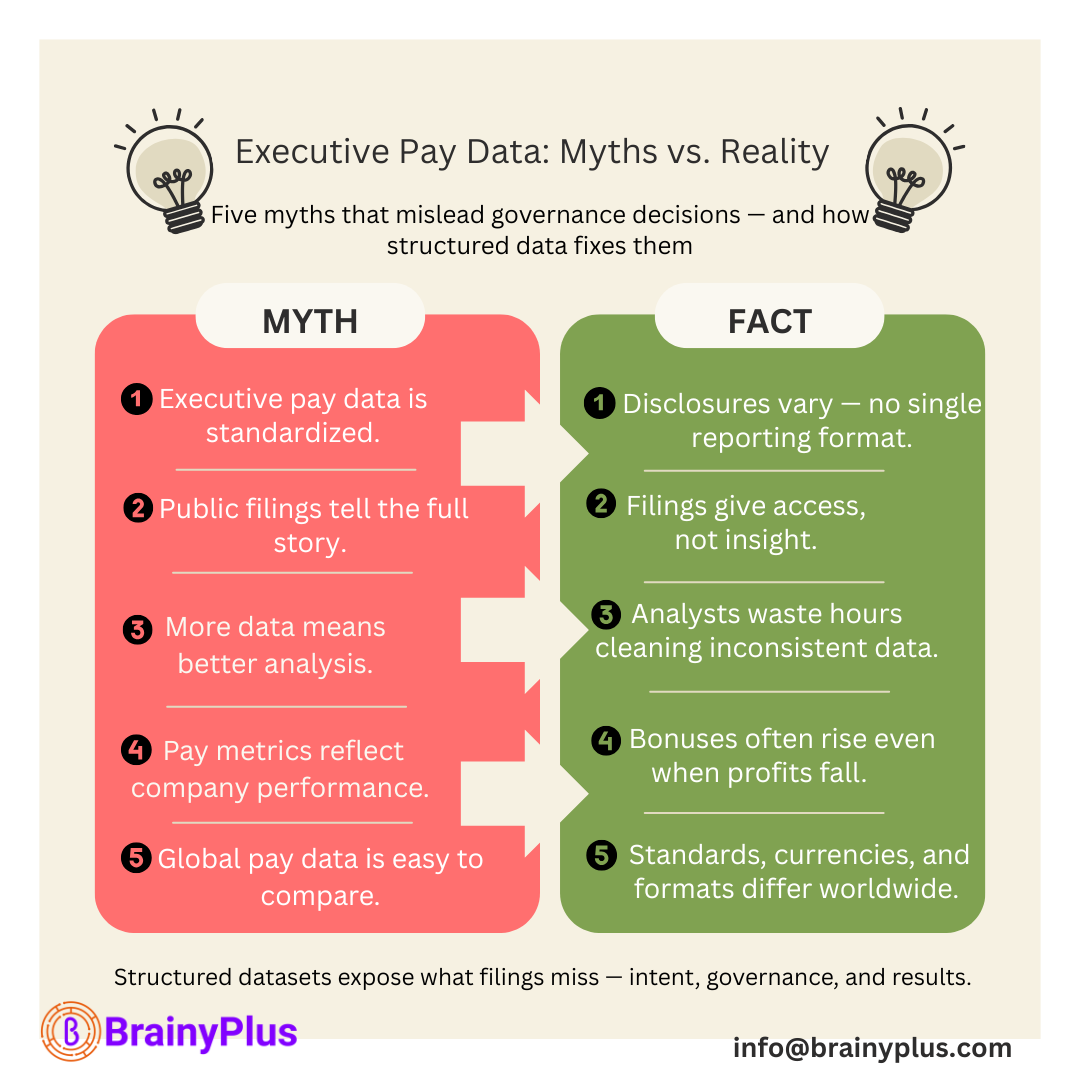

Myth 1: Executive pay data is standardized and easy to compare.

Reality: No two companies report the same way.

One calls it a “performance bonus,” another a “non-equity incentive.”

Equity awards are valued differently, and some perks aren’t disclosed.

Without structure, comparison becomes guesswork.

Myth 2: Public filings give the full picture.

Reality: They offer access — not insight.

The real value comes from connecting those scattered disclosures into clean, comparable data.

Otherwise, governance analysis, peer benchmarking, or pay-for-performance studies can easily point in the wrong direction.

Myth 3: More data means better analysis.

Reality: Quantity doesn’t equal clarity.

Analysts spend hours cleaning filings instead of analyzing them.

Structured datasets separate the signal (leadership intent) from the noise.

Myth 4: Pay metrics directly reflect company performance.

Reality: Pay outcomes don’t always track business results.

Bonuses can be paid despite weak financials, and equity awards may rise on market momentum rather than leadership impact.

Without structure, it’s hard to see whether pay truly rewards long-term success — or short-term gains.

Myth 5: Global pay data can be analyzed the same way everywhere.

Reality: Disclosure standards differ widely by region — from detailed SEC filings in the U.S. to minimal reporting in emerging markets.

Structured datasets reconcile formats, currencies, and governance codes for consistent comparison.

Why Decision-Makers Care

Structured compensation data isn’t a report add-on-it’s a decision advantage.

Boards design fair, defensible pay plans.

Investors detect red flags and align pay with value creation.

ESG analysts track incentive links to sustainability.

Consultants model trends and advise with evidence.

How BrainyPlus Helps

Executive pay data may be public-but rarely usable.

BrainyPlus structures and standardizes these filings into analysis-ready datasets, built only on client order from public disclosures.

Verified and normalized across companies and geographies

Field-level detail-salary, bonuses, equity, incentives

Delivered in custom, model-ready formats

#BrainyPlus #ExecutiveCompensation #GovernanceIntelligence #InvestmentInsights