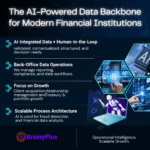

In today’s rapidly evolving financial ecosystem, data has become the new capital. Banks are no longer defined only by their assets or branch networks -but by their ability to collect, connect, and interpret information to make smarter, faster decisions.

At BrainyPlus, we believe data-driven intelligence is not just a technology initiative – it’s the foundation for sustainable growth, customer trust, and strategic foresight.

The Data Universe Behind Every Bank

To stay competitive, banks must harness diverse data streams – structured, unstructured, internal, and external – each offering unique insights into performance, risk, and opportunity.

Internal Banking Data provides the foundation for decision-making:

Customer data reveals preferences and behavior patterns that shape personalized experiences.

Transactional data captures every deposit, withdrawal, and payment – vital for fraud detection and predictive analytics.

Credit data helps assess lending risk and improve portfolio health.

Operational and compliance data ensure efficiency, transparency, and regulatory adherence (AML, KYC, audits).

External Market Data gives broader context:

Economic indicators, market movements, demographic trends, and credit bureau information help banks forecast and adapt to market shifts.

Alternative & Unstructured Data creates a new edge:

Social media sentiment, geolocation insights, satellite imagery, and web traffic analysis reveal emerging patterns in real time – often before traditional metrics catch up.

Turning Data into Better Decisions

When combined and analyzed, these data sources empower banks to:

Strengthen risk management by predicting defaults, fraud, or market volatility.

Deliver personalized experiences using 360° customer views.

Improve operational efficiency by automating repetitive processes.

Execute targeted marketing with precision segmentation.

Enable data-driven leadership through real-time dashboards and intelligent analytics.

The BrainyPlus Advantage

At BrainyPlus, we help banks and financial institutions unlock the full potential of their data – from collection and cleansing to intelligent analytics and performance benchmarking.

Our frameworks integrate structured and unstructured data sources, empowering decision-makers with insights that are timely, transparent, and actionable.

In a world where every transaction leaves a digital footprint, the future belongs to banks that see beyond the numbers – transforming data into direction.

BrainyPlus – Empowering Financial Institutions with Intelligent Data for Smarter Decisions.

#Banking #Fintech #DataIntelligence #DigitalTransformation #FinancialAnalytics #RiskManagement #CustomerExperience #OperationalExcellence #BrainyPlus #DataDrivenDecisions