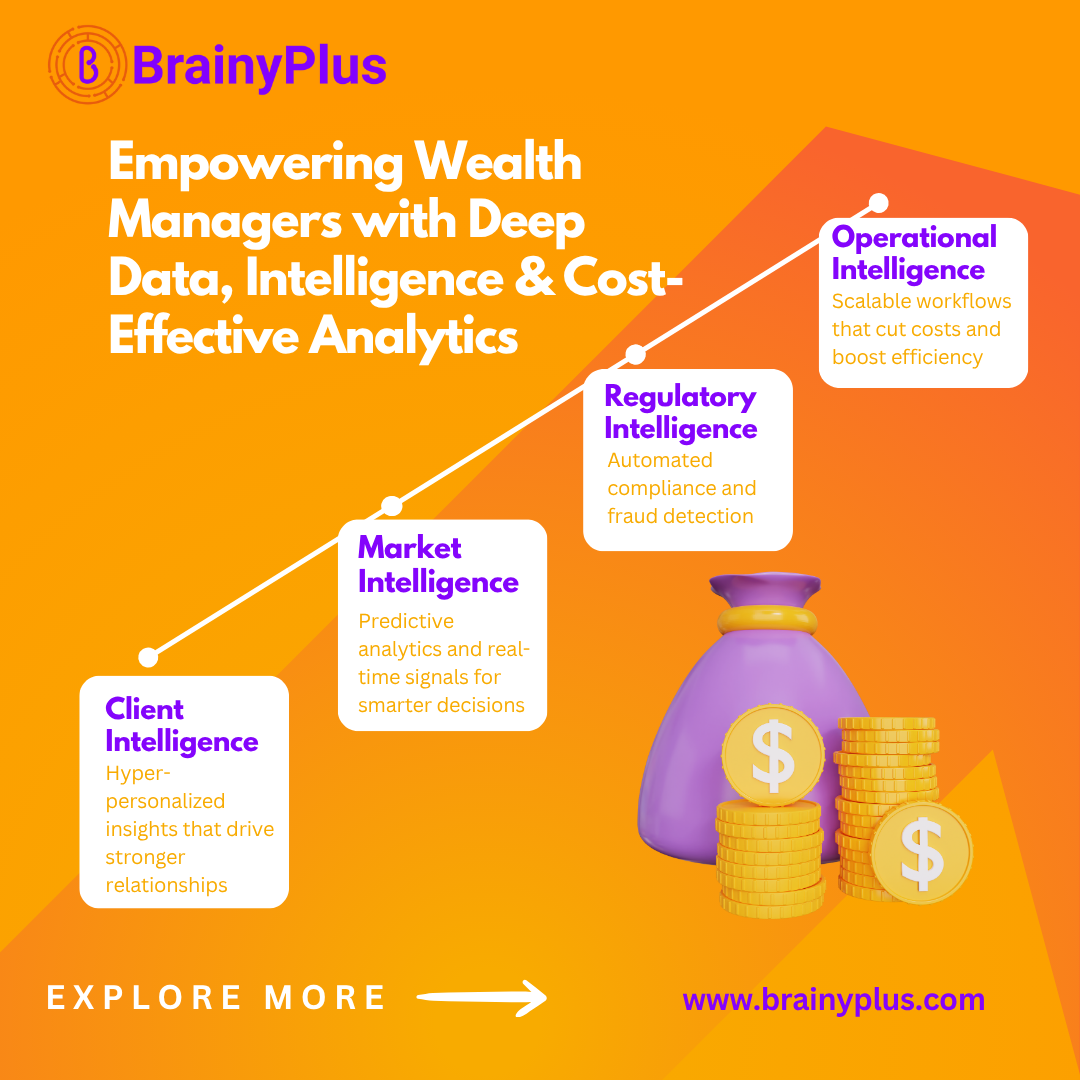

Wealth management firms worldwide are under unprecedented pressure to deliver hyper-personalized advice, anticipate client needs, comply with evolving regulations, and outperform in increasingly complex markets.

Traditional data platforms often provide only surface-level datasets-leaving wealth managers without the niche, high-granularity intelligence required to build a real competitive edge.

This is where BrainyPlus transforms the game.

BrainyPlus provides a unified, cost-effective data intelligence backbone designed specifically for wealth managers. From client-level insights to market signals, regulatory intelligence, and alternative datasets, BrainyPlus gives firms the depth of information and analytical power normally accessible only to top-tier institutions.

Client Intelligence: Hyper-Personalized Wealth Management

• Advanced segmentation by life stage, risk appetite, investable surplus, and portfolio behavior

• Behavioral insights from transactions, communications, and digital interactions

• AI-driven personalized recommendations aligned to unique financial goals

• Proactive intelligence that improves client experience and long-term retention

Market & Investment Intelligence: Faster, Smarter Decisions

• Predictive analytics on trends, asset performance, and risk indicators

• Real-time market monitoring to adjust portfolios at speed

• Sentiment analysis across global news and digital signals

• Deep ESG intelligence to support ethical, impact-oriented portfolios

Regulatory & Compliance Intelligence

• Automated compliance checks and real-time regulatory updates

• Intelligent AML/Fraud detection using anomaly and pattern analysis

• Automated data preparation for global regulatory reporting framework

Operational Intelligence for Scale

• Process automation for reporting, rebalancing, and data workflows

• Enterprise-grade data aggregation across custodians, brokers, fintech apps

• Workflow optimization that reduces costs and increases efficiency

Alternative & Niche Data (The True Differentiator)

This is where BrainyPlus gives global wealth managers a strategic, defendable advantage-by collecting niche, hard-to-access datasets traditional platforms don’t offer:

• Industry-specific alternative data

• Localized business activity signals

• Micro-market sentiment

• Behavioral intent data

• Deep-dive ESG disclosures

• Emerging-market private company intelligence

These unique datasets enable wealth managers to uncover patterns and opportunities that competitors simply.

BrainyPlus empowers wealth managers to operate with institutional-grade intelligence at highly optimized data acquisition costs-while unlocking niche insights

#WealthManagement #InvestmentIntelligence #AlternativeData #AIinFinance #DigitalTransformation #ESGData #DataAnalytics #ClientIntelligence #FintechInnovation