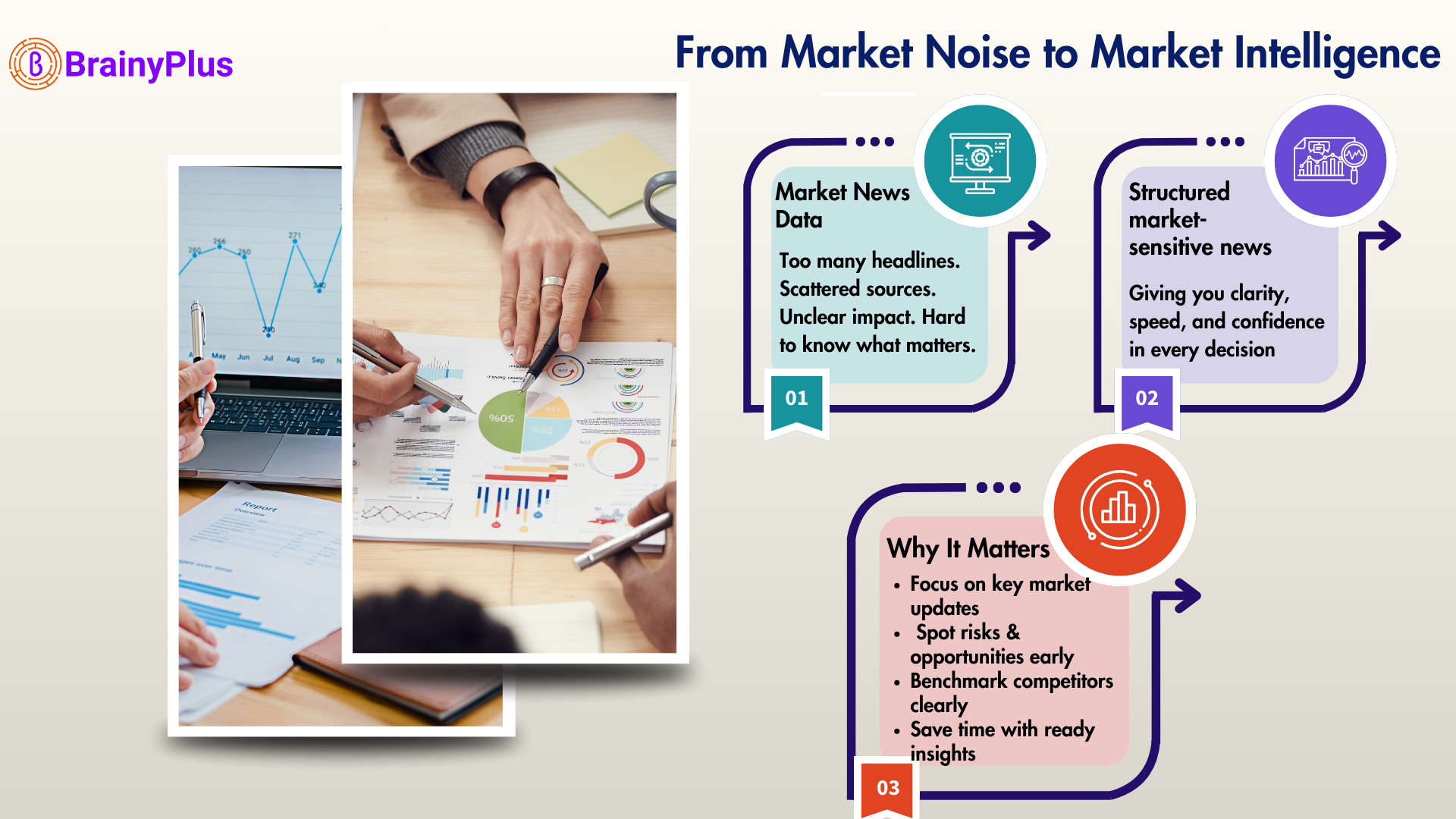

Why do markets often react to a headline before a balance sheet?-Because news breaks instantly-and it moves faster than numbers.

Think about it. one unexpected earnings update, a sudden regulatory change, or news of a merger can shift stock prices in minutes. The real challenge for investors and businesses isn’t finding news-it’s knowing which updates actually matter, and being able to use them in time.

The reality is:

Thousands of disclosures are published every day.

Updates are scattered across filings, websites, and media.

Most of it is noise. Only a fraction is material.

By the time you sift through it all, the market has already moved.

So, what’s the fix?

Not “more news.” Not bigger feeds.

The solution is structured market-sensitive news.

Instead of drowning in headlines, you get signals you can use.

Here’s how it works:

Identify sources – filings, announcements, trusted media.

Classify events – earnings, M&A, leadership changes, regulatory shifts.

Link entities – connect each update to the right company or sector.

Score sentiment – positive, negative, or neutral.

Flag potential impact – highlight events that could matter (without speculation).

This turns raw noise into intelligence.

Why It Matters for Decision Makers

If you’re an investor, analyst, or business leader, structured news helps you:

Focus on the updates that move markets

Spot risks and opportunities early

Benchmark competitors and peer

Free up research time with ready-to-use insights.

Where It’s Used

Structured market-sensitive news supports:

Investment Strategies – Tracking signals from M&A or earnings surprises.

Portfolio Monitoring – Spotting volatility and sentiment shifts.

Risk Management – Identifying shocks and hedging exposures in time.

Competitive Benchmarking – Comparing how peers are affected.

Research Support – Reducing manual data collection.

And Where BrainyPlus Fits In

We believe intelligence comes from trust, not assumptions.

That’s why BrainyPlus structures market-sensitive news only from public sources, validates it for accuracy, and delivers it in client-specific formats.

So when the market moves, you’re not drowning in headlines-

you’re acting on signals that matter.

#BrainyPlus #MarketSensitiveNews #InvestmentIntelligence #PublicData #StructuredData #RiskManagement #FinancialServices #DataOperations