Financial and fundamental data should be the backbone of decision-making. Annual reports, balance sheets, income statements, and investor presentations are publicly available and intended to inform stakeholders.

Yet availability does not equal usability. Filings may contain the right numbers, but they rarely arrive in a form decision makers can apply directly to analysis or strategy.

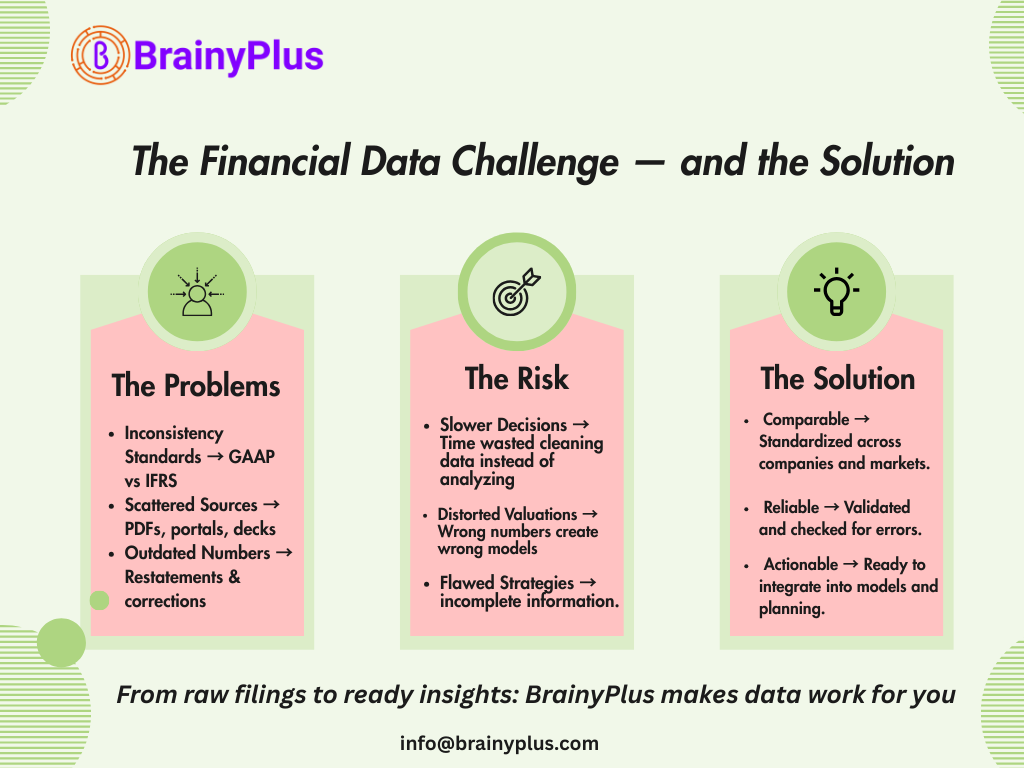

Where the Problems Begin

Inconsistent Standards

A company reporting under GAAP cannot be compared directly with one under IFRS or local rules. Line items may look alike but reflect different calculations. Without normalization, comparisons are unreliable.

Fragmentation Across Sources

Data is scattered across PDFs, portals, and investor decks. Analysts spend more time collecting and cleaning than analyzing-slowing down decisions.

Outdated or Corrected Numbers

Restatements or late disclosures can go unnoticed. Outdated figures distort valuations and risk assessments, leading to flawed strategies.

Why Structured Data Matters

When properly structured, financial and fundamental data becomes:

Comparable across companies, sectors, and regions.

Reliable through validation and anomaly checks.

Actionable when integrated into valuation models and planning.

Instead of preparing numbers manually, teams can focus on insights-and act with speed and confidence.

What Kind of Data Matters Most

At BrainyPlus, we help clients structure the most relevant publicly available financial and fundamental data, including:

Financial Statements→P&L, Balance Sheet, Cash Flow-the foundation of performance analysis.

Key Ratios & KPIs→ EPS, ROE, ROA, D/E, EBITDA, margins-essential for benchmarking and comparisons.

Ownership Data→ Shareholding patterns and major investors-vital for governance and control analysis.

Management & Governance Profiles→ Leadership and board composition -indicators of stability and oversight.

Corporate Actions→ Dividends, buybacks, splits, mergers-events that reshape valuation and shareholder value.

Industry& Classification Data→ Standardized SIC/NAICS mapping supporting peer-to-peer comparability.

How BrainyPlus Helps

At BrainyPlus, we do not alter disclosures or make predictions. We specialize in converting public company data into structured, validated intelligence delivered exactly as required.

Research & Collection→From filings, exchanges, and investor disclosures.

Structuring & Standardization→Normalizing across standards and geographies.

Validation & Quality Checks→Reducing errors and ensuring consistency.

Custom Delivery→Excel, CSV, or API-aligned with client workflows.

By structuring only the datasets our clients order, BrainyPlus enables leaders to work with clarity, comparability, and confidence-ensuring decisions are grounded in intelligence, not noise.

#BrainyPlus #FinancialData #FundamentalData #InvestmentIntelligence #DataOps