For investors, both public equity and private equity offer unique opportunities. But the real challenge is the same: how to transform scattered, publicly available data into structured intelligence that supports confident decisions.

At BrainyPlus, we collect, structure, and validate only publicly available information-tailored to each client’s order. This ensures that investors, analysts, and fund managers can move from data overload to clear, actionable intelligence.

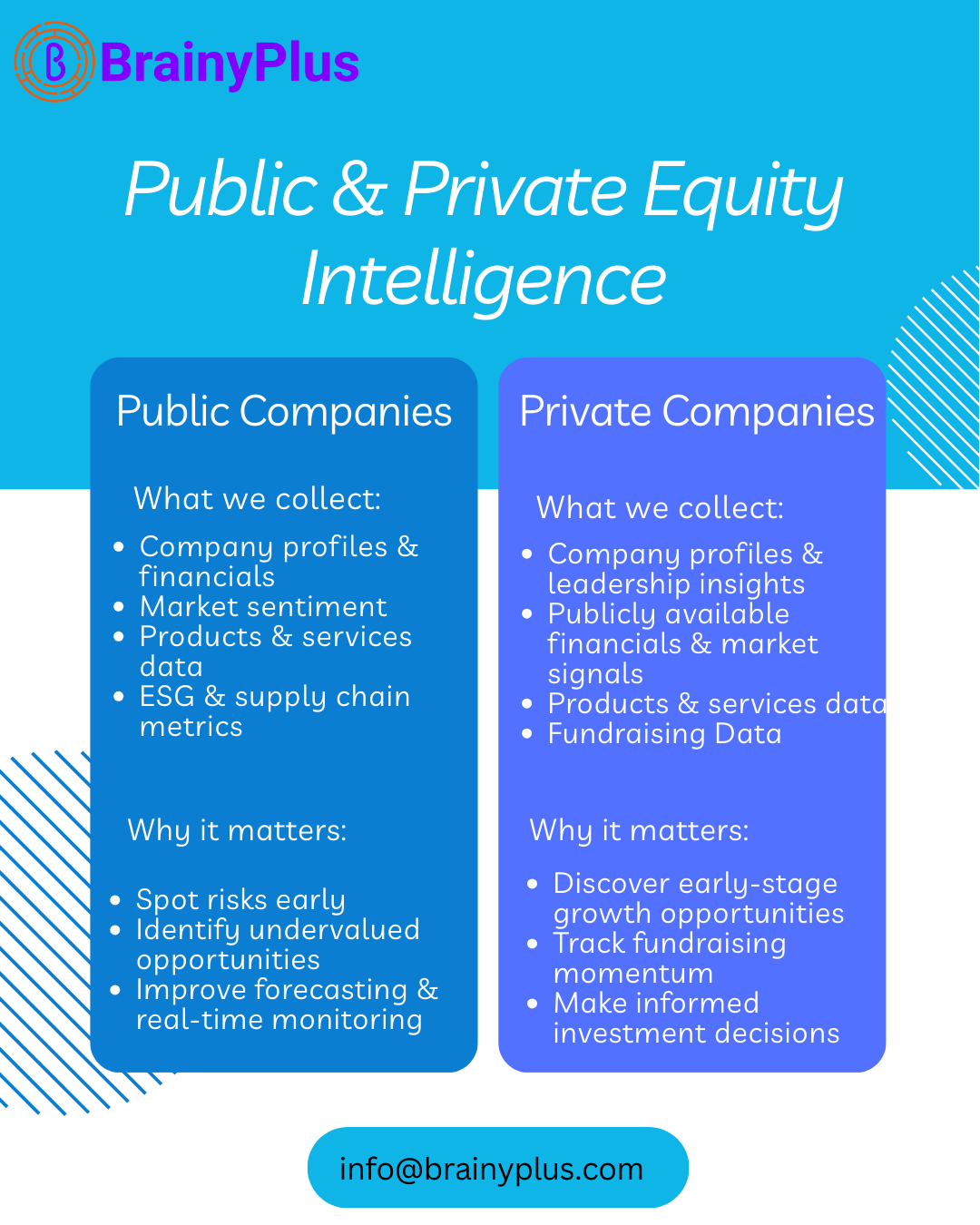

Structured Public Equity Intelligence

Public companies disclose information through filings, reports, and press releases. But raw data alone isn’t immediately useful.

What we collect & structure:

Global company profiles, financial filings, earnings reports, and corporate executive compensation

Market sentiment from news, social media, and earnings calls; stock ownership structures; products & services data

Supply chain relationships, operational and ESG metrics, and M&A data

Why it matters:

Reduced Risk–Spot red flags beyond financial statements

Improved Forecasting–Identify market patterns using structured data

Faster Due Diligence–Automated sourcing and validation save time

Hidden Opportunities–Detect undervalued stocks earlier

Real-Time Monitoring–Track KPIs and ESG performance continuously

Structured Private Equity Intelligence

Private equity data is often scarce and fragmented. Valuable public signals exist in press releases, announcements, and industry updates-and BrainyPlus structures these into usable insights.

What we collect & structure:

Private company profiles

Publicly available financials and market signals

Products & services data from company sites and materials

Fundraising announcements and related news

Why it matters:

Spot Early-Stage Opportunities–Identify growth companies with confidence

Track Fundraising Activity–Assess momentum and investor interest

Strengthen Investment Screening–Build informed strategies for portfolio diversification

The Investor’s Lens

Public equity:Transparent, data-rich-but scattered

Private equity:Less transparent-but full of potential

Common need:Both require structured, validated intelligence to move from noise to clarity

The BrainyPlus Approach

We don’t provide off-the-shelf datasets. We work on order, based on your requirements:

Collect only publicly available data

Structure it into formats aligned with your objectives

Validate for accuracy, completeness, and usability

Deliver intelligence that integrates directly into workflows

When investors access structured equity intelligence-public or private-they can reduce risk, accelerate due diligence, and act with clarity.

BrainyPlus transforms scattered equity data into competitive investment intelligence.

#BrainyPlus #PublicEquity #PrivateEquity #InvestmentIntelligence #StructuredData #DataAnalytics