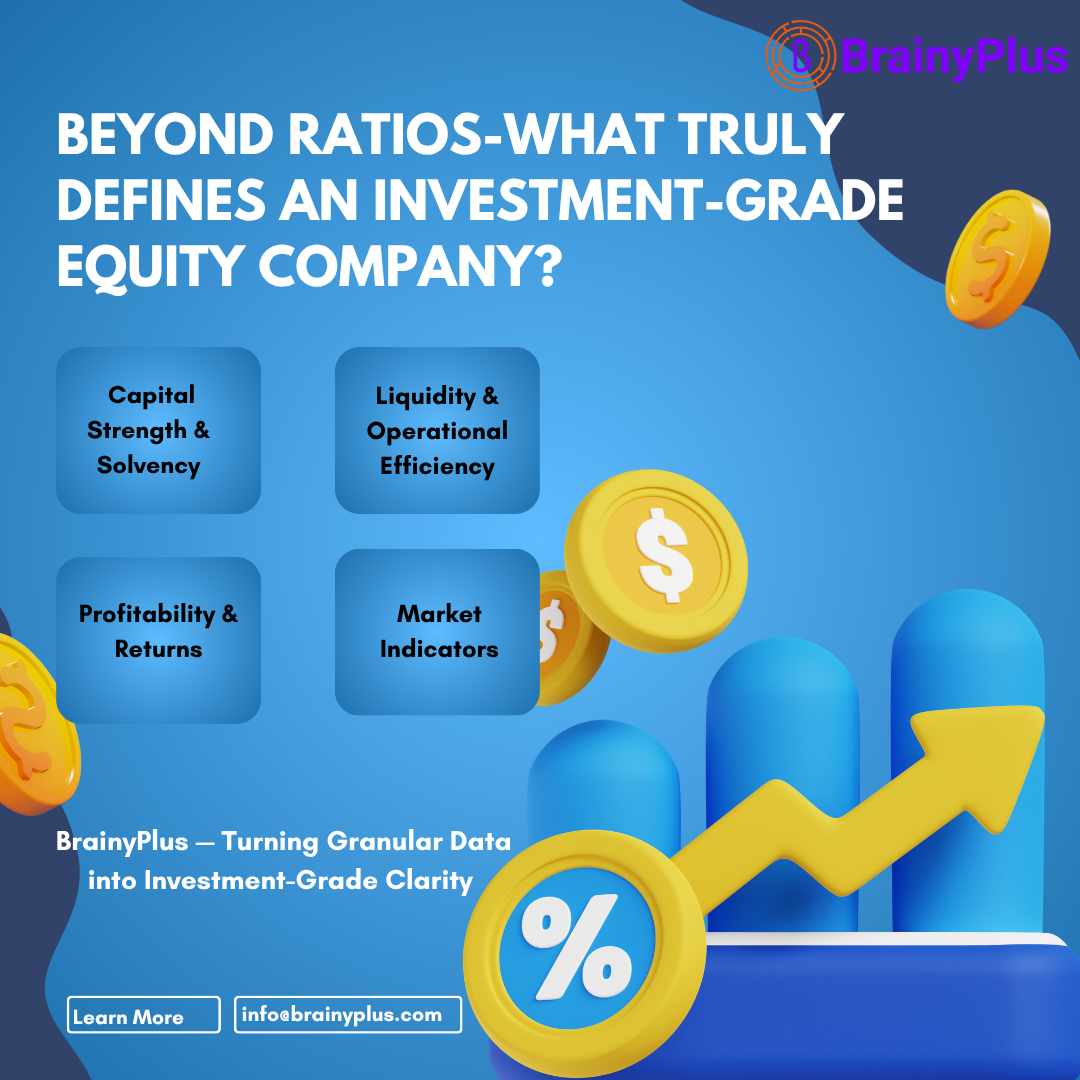

An investment-grade equity company is one that demonstrates superior financial strength, consistent earnings, disciplined capital allocation, and long-term market stability. These companies attract institutional investors because they provide lower volatility, predictable performance, and resilient shareholder value.

But identifying such companies today requires far more than headline ratios. Data platforms and equity analytics providers must capture deep, multi-year, granular data to determine true investment-grade equity quality.

Characteristics of Investment-Grade Equity Companies

• Strong balance sheet, disciplined leverage, and predictable cash flows

• Consistent earnings and margin stability

• Lower volatility and better downside protection

• High-quality governance and transparency

• Sustainable long-term equity returns and stable payout policies

Compared to speculative or high-beta equities, investment-grade companies show:

• Lower risk

• Higher institutional ownership

• Greater resilience during economic cycles

Granular Data Required to Identify Investment-Grade Equity Companies

Capital Structure & Solvency

• Debt-to-Equity Ratio

• Interest Coverage Ratio

• Free Cash Flow Stability

• Share Buyback Quality

Liquidity & Operational Strength

• Cash Ratio, Current Ratio

• Working Capital Trends

• Receivables/Payables Cycles

Profitability & Efficiency

• EBITDA Margin

• Operating Margin

• Gross Margin Stability

• ROE & ROIC

Market-Based Indicators

• Beta & Volatility Patterns

• Institutional Ownership Levels

• P/E and Forward EPS Consistency

• Multi-year price stability vs peers

Deep equity intelligence requires:

Multi-year trends

Footnote-level disclosures

Segment-level insights

Peer benchmarking

Management commentary signals

Simple scraping cannot deliver this granularity-but BrainyPlus can.

How BrainyPlus Helps Data Platforms Build Investment-Grade Equity Intelligence

BrainyPlus enables deep, multi-layered equity data extraction with automation + ML + structured intelligence.

Data platforms benefit through BrainyPlus by gaining:

Multi-year fundamental extraction from filings & footnotes

Clean, structured datasets for modeling and screening

Segment-level revenues, margins, and cash flows

Governance and risk signals captured from narrative text

Ability to launch premium products like “Investment-Grade Equity Engines”

Stronger platform differentiation and new revenue opportunities

By going beyond traditional data feeds, BrainyPlus helps platforms deliver richer equity intelligence and empower investors with deeper insights.

#BrainyPlus #InvestmentGrade #EquityAnalysis #FinancialData #EquityResearch #DataPlatforms #InvestmentIntelligence #CapitalMarkets #FundamentalAnalysis #FinancialModeling #InvestorInsights #FinTech #DataExtraction