In private equity, timing and conviction define success. But even the most experienced investment teams often find themselves second-guessing their data-especially when evaluating private companies.

Despite access to platforms and databases, many firms face a recurring challenge:

We have data-but is it decision-ready?

The Quiet Risk: Incomplete, Misaligned, or Outdated Intelligence

Private company data often looks comprehensive at first glance. But once diligence starts, the cracks begin to show:

Financials that lack verification or industry context

Profiles that are outdated or templated

No clarity on product-level details or operating structure

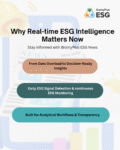

Fundraising news that arrives too late to act

These gaps don’t just slow down deal teams-they raise risk and reduce confidence. And in private equity, manual rework is a hidden cost that adds up fast.

The Real Problem: It’s Not About Volume-It’s About Relevance

Private equity firms don’t lack access.

They lack data that’s aligned with their exact investment thesis whether that’s sector-specific, stage-specific, or geography-based.

Off-the-shelf platforms aren’t built for that. That’s why many firms turn to BrainyPlus.

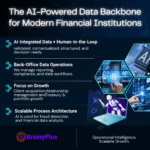

The BrainyPlus Difference: Intelligence, Made to Order

We don’t sell dashboards. We don’t lock you into subscriptions.

At BrainyPlus, we operate on demand, based on your order delivering only what your team actually needs.

Our Private Equity Investment Intelligence solutions include:

Tailored Company Profiles-With insights into leadership, ownership, structure, and more

Verified Financials – Curated financials to support your valuation and benchmarking models

Product & Service Intelligence – Understand the true scope of what a company offers

Fundraising & Deal Signals – Real-time alerts on capital raises and investor activity

Each insight is built from scratch-researched, validated, and structured by our team to fit your exact mandate.

Why This Matters for PE Teams

With BrainyPlus, firms can:

Move faster in evaluating targets

Save time spent on data cleanup and verification

Reduce uncertainty in decision-making

Build confidence from day one of the deal cycle

Because better data isn’t about quantity –

It’s about having the right insights, at the right time, built to your order.

Let’s Build Your Next Advantage

Whether you’re sourcing new deals, tracking market shifts, or managing a portfolio – you deserve intelligence that’s made for your strategy, not just pulled from a platform.

#PrivateEquity #InvestmentIntelligence #DealSourcing #DataDrivenDecisions #BrainyPlus #AlternativeInvestments #PrivateMarkets #FinancialResearch #DataOps #PrivateCompanyInsights