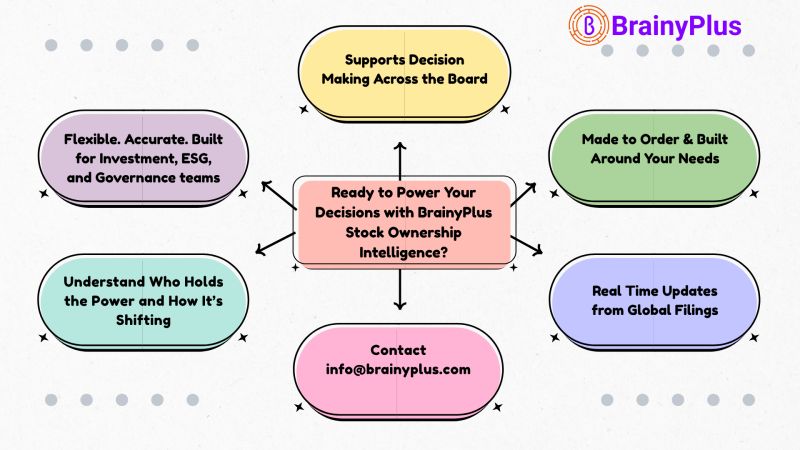

Understand who holds the power-and how it’s shifting.

In today’s capital markets, ownership clarity isn’t optional-it’s strategic intelligence.

At BrainyPlus, we specialize in building made-to-order Stock Ownership datasets that go beyond static feeds and fragmented disclosures. Our clients don’t settle for one-size-fits-all platforms- they rely on custom intelligence built around their portfolios, geographies, and internal tools.

What Is Stock Ownership Data-and Why It’s Crucial

Stock Ownership Data tells you who owns shares in a company-whether it’s institutions, insiders, activists, or sovereign funds.

When structured right, it answers vital questions:

Who are the real decision-makers behind the stock?

Is institutional or insider ownership growing or declining?

Are ESG-focused investors building a position-or quietly exiting?

How much of the float is truly “free,” and who controls voting power?

Who Uses Ownership Data-and What They Do With It

This data supports decision-making across the board:

Asset managers track capital flows and institutional shifts.

IR and corporate governance teams plan outreach, defend against activist risk, and prepare for proxy season.

ESG analysts evaluate shareholder alignment with sustainability priorities.

M&A teams identify likely allies (or blockers) in potential deals.

Fintech platforms enhance user dashboards with meaningful stakeholder insights.

Yet, this data is buried in filings like 13F, TR-1s, insider forms, and local disclosures-often inconsistent, delayed, or fragmented.

What Sets BrainyPlus Apart

We don’t just scrape filings. We build structured, quality-assured datasets aligned to your workflow:

Built from regulatory filings across the countries

Covers institutional holders, insiders, mutual & hedge funds

Includes % ownership, voting power, control stakes, float metrics

Connects with ESG, compensation, and governance data

Delivered in your preferred format: dashboards, research tools, or direct feeds

Reviewed by analysts-not just processed by bots

Whether you’re tracking institutional shifts, preparing for proxy season, or analyzing insider trends-we deliver reliable ownership intelligence when and how you need it.

Why Made-to-Order Matters

Most data platforms lock you into rigid coverage.

At brainyplus, we build around your needs:

Your target companies or regions

The depth, frequency, and freshness you need

Your preferred format, structure, or integration method

This flexibility makes us the ideal data partner for investment firms, ESG research providers, and governance analysts who demand accurate, scalable, and cost-effective operations support.

#BrainyPlus #StockOwnership #InvestmentIntelligence #CapitalMarkets #GovernanceAnalytics #DataOperations #CustomData