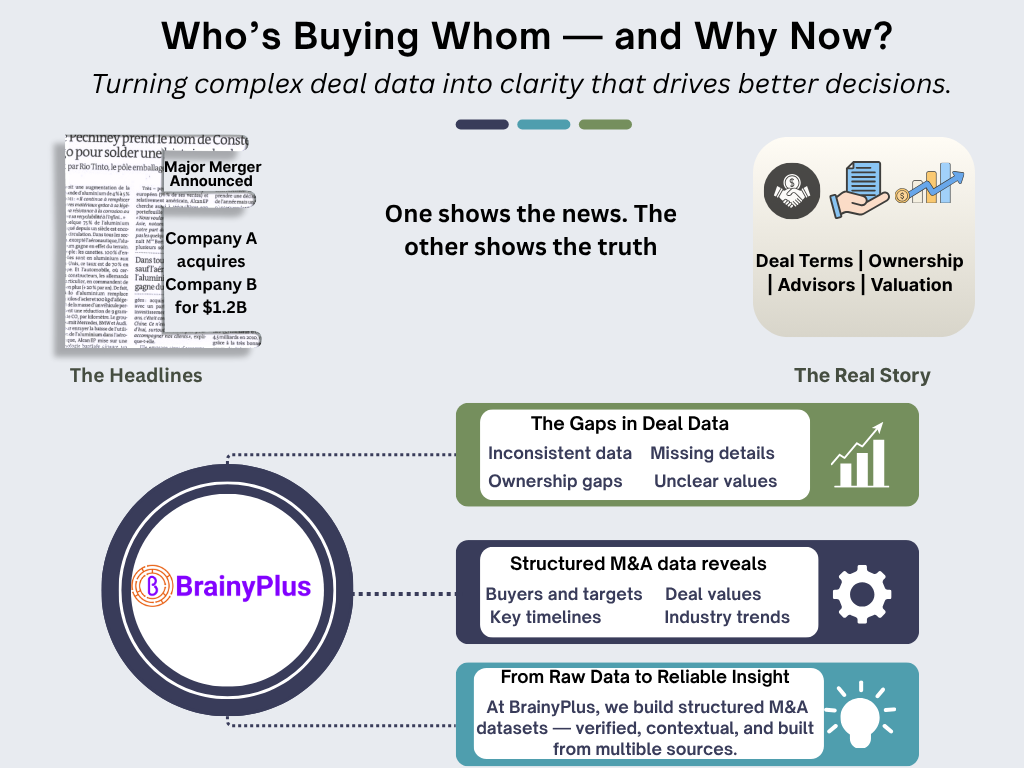

Every deal tells two stories.

The one you read in the headlines-and the one buried deep in filings, ownership changes, and regulatory notes.

Guess which one drives better decisions?

For decision-makers, the real challenge isn’t finding M&A data-it’s trusting it.

Information exists everywhere announcements, reports, and databases-but rarely in one place, one format, or one timeline.

By the time it’s organized, the next deal has already moved on.

Where the Data Breaks Down

Even the most sophisticated teams hit roadblocks:

Disclosures vary by region and format

Key deal terms go unreported or delayed

Ownership records conflict across filings

Valuations lack standardization

These gaps lead to confusion – missed signals, flawed benchmarking, or integration setbacks after the deal closes.

That’s where structure changes everything.

Connecting the Dots Across the Deal Landscape

Structured M&A data transforms scattered public information into a single, comparable view of what’s really happening.

It organizes key details such as:

Acquirer and target identities

Deal size, structure, and currency

Announcement and closure timelines

Industry, geography, and ownership data

Advisor details and regulatory milestones

Together, these reveal how industries consolidate, which players are most active, and where the next opportunities may emerge.

Real-World Application

Structured M&A data supports analysts, strategists, and advisors – helping them benchmark deals, identify targets, and assess ownership or compliance risks.

Transforming Deal Data Into Decision-Ready Insight

At BrainyPlus, we don’t just collect data – we build intelligence from what’s already public.

Every client request begins with understanding the specific objective-whether it’s tracking deal activity in a sector, mapping acquirer behavior, or identifying valuation trends.

Our research team then sources verified information from:

• Stock exchange and regulatory filings

• Corporate announcements and annual reports

• Government and company registries

• Credible news and investor disclosures

Each record is standardized, validated across multiple sources, and tagged by industry, geography, and deal type for easy comparison.

The result-a traceable, consistent, and high-quality dataset that helps decision-makers move from scattered data to confident action.

#MergersAndAcquisitions #BrainyPlus #InvestmentIntelligence #DealData hashtag#FinancialAnalytics #CorporateStrategy