In today’s fast-moving business landscape, mergers, acquisitions, divestitures, and takeovers aren’t just headlines – they signal strategic direction, market shifts, and changing competition.

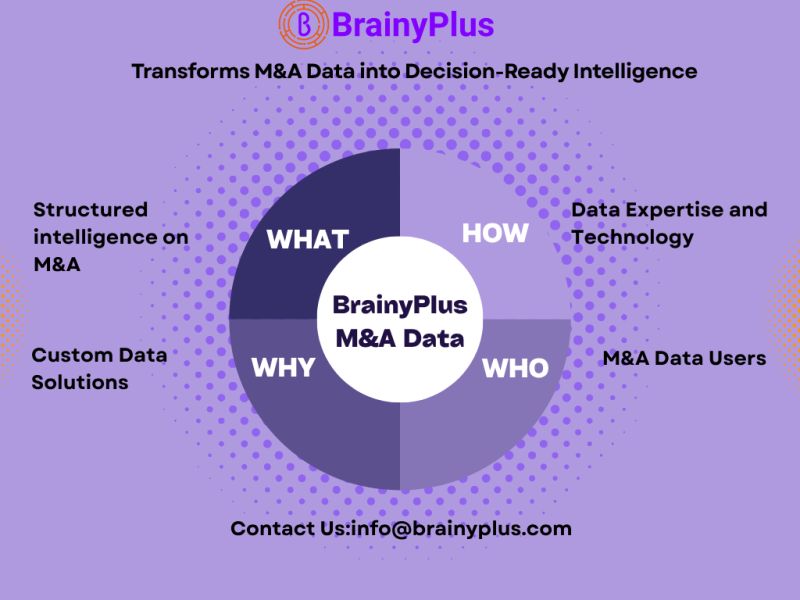

At BrainyPlus, we understand that every deal holds deeper meaning – from its purpose to the ripple effects it creates. That’s why we’ve built the capabilities to aggregate, enrich, and deliver contextual M&A data, tailored to your needs.

Whether you’re tracking trends, benchmarking deals, or building ESG models — our data is built on request, smart by design, and ready to power your decisions.

What Is M&A Data – And Why Is It Valuable?

M&A data provides structured intelligence on:

Deal announcements and status

Buyer and seller profiles

Deal size, valuation, and currency

Deal structure (cash, stock, hybrid)

Industry/region focus and strategic intent

Ownership changes and corporate links

These insights help decode why deals happen, who’s reshaping markets, and what it means for future strategy and investment.

Who Uses M&A Data – and How?

Investors & Private Equity Firms

Track deal flow, spot trends, and benchmark valuations for smart investment moves.

Consulting & Advisory Firms

Deliver timely insights, shape M&A strategy, and offer competitive guidance.

ESG & Risk Analysts

Monitor ownership shifts, compliance risks, and supply chain exposure.

Corporate Strategy Teams

Track competitors, evaluate targets, and align growth plans with market dynamics.

Financial Institutions

Depend on accurate data to support structuring, underwriting, and deal risk.

Regulators, Legal Teams & Academics

Analyze deal trends for compliance, antitrust oversight, and market research.

How BrainyPlus Makes M&A Data Smarter – and Built for You

We don’t deliver off-the-shelf feeds. At BrainyPlus, we build custom data solutions aligned with your goals.

Key Capabilities:

Relationship Mapping

See beyond the transaction – uncover ownership changes, group structures, and affiliations.

Context-Aware Structuring

Enrich deal data with sector context, ESG flags, and macro insights.

Multi-Source Aggregation

From filings to global news – all in one clean, reliable stream.

On-Demand Delivery

Select filters – industry, geography, size, time – and we’ll tailor delivery to your workflow.

At BrainyPlus, your data works how your business works – flexible, contextual, and decision-ready.

Let’s Build Smarter M&A Intelligence Together

In a changing world, the right M&A data -delivered your way – drives smarter, faster decisions.

#MergersAndAcquisitions #MAData #InvestmentIntelligence #PrivateEquity #DealFlow #BrainyPlus #DataOperations #SmartData #ContextualData #CorporateStrategy #ESGAnalytics #FinancialData